Investors and regulators increasingly expect companies to have both a decarbonization strategy (greenhouse gas accounting, science-based targets, low-carbon transition plan) and a climate resiliency strategy (managing acute/chronic physical risks and regulatory/market transition risks). In a recent webinar hosted by the National Investor Relations Institute (NIRI), Nate Kimball, Sustainability Practice Lead at Antea Group USA, and Tara Brown, the Director of Corporate Responsibility and ESG at Jack Henry & Associates, discussed key emerging trends in carbon reduction and climate risk assessments, including Scope 3 greenhouse gas accounting, the Science-Based Targets Initiative (SBTi), internal carbon prices, and the Task Force on Climate-Related Financial Disclosures (TCFD).

What are Climate-Related Risks?

There is growing pressure from investors and regulations for businesses to disclose their climate-related risks. TCFD focuses on four types of climate risks that are either physical or transition risks:

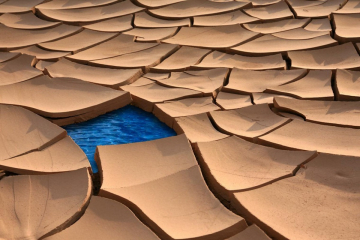

- Chronic Physical Risks: Long-term risks that present daily disruptions, such as sea-level rise.

- Acute Physical Risks: Short-term risks that occur frequently, such as intense storms or severe fires.

- Regulatory Transition Risks: Risks associated with government regulatory actions to reduce emissions.

- Market Transition Risks: Risks associated with where the market is moving and what customers want.

How can Businesses Address Climate Risks?

Climate risks can be addressed through your ESG program and should be viewed as an ongoing practice that companies repeat as progress is made and initiatives evolve. To address climate-related risks and implement TCFD disclosures through your ESG programs, utilize the four steps below:

- Risk and Opportunity Assessment: Identify various climate scenarios for analysis and gather data. Assess the physical and transition risks associated with the scenarios and prioritize interventions based on the magnitude of risk across business units.

- Disclose risks and opportunities through TCFD: Merge current reports (i.e., SASB, GRI, CDP) with new findings and communicate the value of resilience and sustainability to your stakeholders early on and future-proof your sustainability reporting against future SEC regulations.

- Analyze opportunities: Take action and develop a low carbon transition plan and create a resilience strategy and investment plan for facilities. This step will help you identify the riskiest physical locations and products to divest from and access public incentives.

- Create long-term business value: Create value by attracting and retaining investors and customers, managing operational and capital costs, reducing litigation risk, retaining a healthy and productive workforce, and guiding long-term corporate strategy.

This is a cyclical process, and we recommend engaging in it in a two-to-four-year cycle to evaluate new or emerging climate-related risks and opportunities and make any necessary modifications to your risk assessment.

Leveraging Climate-Related Business Opportunities

Carbon and climate goals can be leveraged to your benefit as well. Some actionable examples of how this can be done include:

- Resilience: Physical improvements can be made to facilities that are at physical risks. Investments from the community can be made in a way that benefits everybody. You can also divest from risky assets and manage risk within the supply chain.

- Resource Efficiency: You can do everything you can to reduce emissions, increase on-site generation of energy, diversify energy sources, and price your carbon emissions with an internal or shadow carbon price.

- Products and Services: Look at what products and services you offer. Can you offer low-carbon services or products? You may need to diversify business activities to offer new products and services.

- Markets Served: Try to access new markets to ensure that your products are satisfying the needs of customers. Align your products with climate-related investor or consumer expectations.

Managing Climate-Related Risks: Jack Henry & Associates

Jack Henry & Associates is a well-rounded tech company that supports financial operations such as banks and credit unions. Their ESG strategy started with a simple philosophy: do the right thing. In 2019, Jack Henry & Associates established a cross-functional team to publish a sustainability report. The first step to publishing a sustainability report was to conduct a materiality assessment with Antea Group to identify key stakeholders and areas of interest for ESG goal-setting and reporting. A Director of Corporate Responsibility position was created in 2020 to head sustainability initiatives, which, combined with their newly established cross-functional team and a materiality assessment, helped leverage Jack Henry & Associates to publish their first sustainability report by the end of 2020.

Looking ahead to 2021, Jack Henry & Associates needed to identify their key priorities and guiding principles. An internal awareness campaign was launched to establish clarity and common understanding across leadership and staff on the company’s ESG principles. The Jack Henry Environmental Playbook was developed as a series of briefs for internal use to establish that common understanding, as well as the key difference between GHG emissions and climate-related risks.

Heading into 2022, Jack Henry & Associates already have plans to publish their next sustainability report and continue to prioritize ESG strategizing for a more climate-resilient business model. They have also set goals to perform EHS audits, expand employee resource groups, and conduct a Scope 3 screening.

Challenges to Developing and Implementing ESG

With an overwhelming number of raters, rankers, reporting frameworks, and options for ESG strategizing, it can be overwhelming to begin ESG reporting as there is so much to learn. It is important to remember that there is no set standard for disclosure and choosing one framework can be difficult, as there is overlap in disclosure approaches and alignment to standards. Many of the most commonly used reporting standards such as GRI, SASB, the UN SDGs, and TCFD are still growing and developing ways for organizations to align to each standard effectively.

In addition, there is also a lot of internal buy-in and analytical work that needs to be done to start developing an ESG strategy. It is key to establish a strong strategic business case and realize how an ESG strategy can add value to the company before proceeding. With the right human and financial capital and a sense of organizational commitment, it can be done.

Helpful resources for getting started

There are several resources available to help you get started on ESG reporting. LinkedIn, ESG Today articles, ESG webinars, and proxy statements all contain helpful information and diverse viewpoints to help you develop an understanding of ESG. ESG frameworks such as TCFD, GRI, and SASB are all publicly available disclosures that serve as a great resource for guidance as well. External expertise is also available to assist you with materiality assessments, GHG inventories, and ESG reporting.

Developing and disclosing an ESG strategy is not just a way to add publicity to your company, rather, it is becoming an essential part of operating a successful and risk-resilient company. Want to begin ESG reporting? The best way to start is to start! While growing pains may initially be present as you begin the process and start to develop internal support, the process will build upon itself and take off in subsequent years.

For help getting started, reach out to our ESG Advisory team to begin building a strategy that’s right for you.

Want more news and insights like this?

Sign up for our monthly e-newsletter, The New Leaf. Our goal is to keep you updated, educated, and even a bit entertained as it relates to all things EHS and sustainability.

Get e-NewsletterHave any questions?

Contact us to discuss your environment, health, safety, and sustainability needs today.